What Is a Mutual Fund

In 2014 there were an estimated 10,000 mutual funds available for sale in the United States. If you are considering a mutual fund, it only makes sense to understand what a mutual fund is and why it is the most popular investment vehicle in the country.

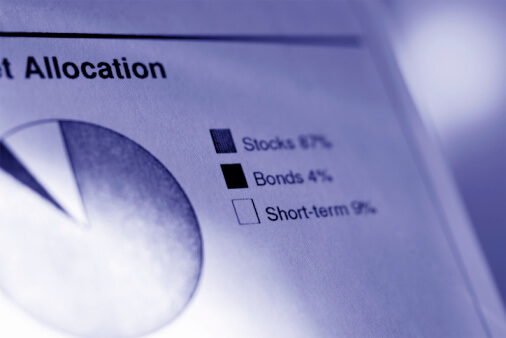

Diversification. Having the money to spread out your investment in more than one stock or bond or certificate of deposit is called diversification, and it is one of the most fundamental elements of successful investing. Mutual funds are collections of stocks, bonds and other investment vehicles in which the diversification has already taken place. Each mutual fund comes with a certain goal, and the investments are chosen to reach that goal – both in the short term and the long run. Diversification helps to make that possible. A diversified mutual fund will do well when the economy is strong, but is designed to minimize losses during a down economy.

Rely on experts. Many of the most successful money managers in the world put together the investment choices in mutual funds that feature different objectives and levels of risk. Instead of relying your own investment knowledge to choose stocks and other investments, and then to make the proper decisions on when to sell some of those stocks or add new stocks to the portfolio, you can lean on a money manager with a history of success. For example, the Magellan Fund offered by Fidelity Investments became the most popular fund in the world under the leadership of fund manager Peter Lynch. From 1977 to 1990, the fund grew from $18 million to $14 billion as Lynch became a household name by averaging a 29-percent return during those 14 years. Today, many investors seek well-known fund managers hoping for a streak of success similar to Lynch’s performance for the Magellan fund.

Choose your level of risk. Every investor wants to be successful, but the level of risk investors feel comfortable with varies widely from individual to individual. Mutual funds include a prospectus that allows potential buyers to find funds with a level of risk they are comfortable with. For example, if your goal is long-term accumulation of wealth for retirement, experts say there is no reason to be overly cautious because minor drops in the market will be erased over time. However, if your objective is a very short-term gain, a more conservative mutual fund that focuses on modest growth without too much risk makes a lot more sense.